News & Releasess

Press Release Financial Figures 3rd Quarter and Nine months 2024

Revenue of €749.1 mn in the nine-month period, with profitability of €76 mn after taxes.

Continuation of positive momentum in Rentals primarily in Greece but also abroad during the 3rd quarter of the year

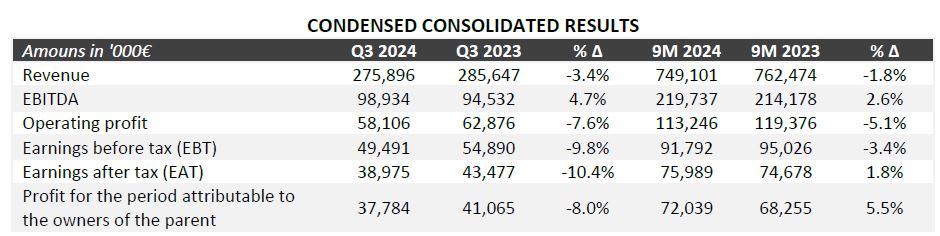

Autohellas Group announces the results for the third quarter of 2024, with consolidated Revenue amounting to €275.9 mn. In the same period, EBITDA amounted to €98.9 mn, while consolidated Earnings after tax (EAT) stood at €39 mn compared to €43.5 mn in the same period last year.

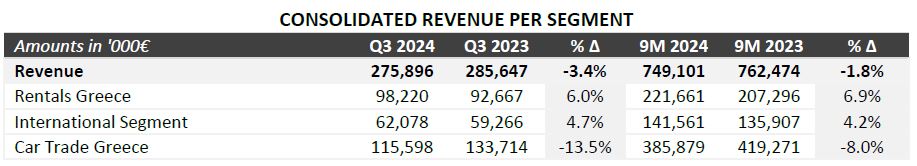

For the nine-month period, consolidated Revenue reached €749.1 mn, compared to €762.5 mn in the same period of last year. Similarly, EBITDA amounted to €219.7 mn, up by 2.6%, while consolidated Earnings after tax (EAT) stood at €76 mn, showing a marginal increase of 1.8%. Both Revenue and operational profitability were supported by another year of exceptionally positive management of the demand for short-term, primarily tourism-related, rentals, as well as by a significant increase in the fleet for long-term rentals over the past 12 months. In contrast, the car trade activity saw a slight decline compared to 2023 but maintained substantial profitability.

Overall, the activity of short-term and long-term rentals in Greece and in other countries where the Group operates, utilizes a fleet of over 61,000 vehicles.

Total profitability for the nine-month period was supported by €9.0 mn in dividends from Aegean Airlines and Trade Estates.

In more detail:

Revenue from the Car Rental activity in Greece increased by 6.9% in the nine-month period of 2024, reaching €221.7 mn. After three years of strong growth and profitability, primarily in short-term/ tourism-related rentals, 2024 has evolved into a robust year for Autohellas’ growth also in long-term rentals which derive exclusively from the domestic market.

In the third quarter of 2024, the strongest one due to seasonality, short-term rentals in Greece saw an increase marked by high fleet utilization rates across all regions of the country. This was a result of the strong operational structure of the organization and the network, despite the significantly increased car rental supply in the market.

Revenue from the International activity related to car rentals reached a total of €141.6 mn, marking a 4.2% increase. In markets outside Greece, the Group effectively leverages a mix of short-term and long-term rentals along with significant outsourcing of services to keep fixed costs low, achieving substantial operational profitability despite smaller operational scales per market. For 2024, profitability remained at a satisfactory level across all international markets, except in Portugal.

The Car Trade activity in Greece showed a decline, contributing a total of €385.9 mn to the Group’s Revenue, compared to €419.3 mn in the same period of last year. This change is mainly attributed (unlike 2023) to the lack of accumulated unfulfilled orders (due to insufficient production) from previous years. It is noted that the activity of Italian Motion (FIAT/JEEP/Alfa Romeo), which is accounted for using the equity method, and therefore does not participate in the consolidated Revenue, recorded sales of €116.4 mn during the nine-month period of 2024, enhancing the Group’s overall activity.