News & Releasess

Autohellas Group: Annual Results 2022

Another year of growth driven by high performance

· Consolidated Revenue reaching €765.6 million and 82.5 million Earnings After Tax increased by 57.4%

· Proposed dividend at 0.65 euros / share

Autohellas announces annual results for 2022, recording a new historical milestone for the Group, both in revenue and profit levels, for the second consecutive year.

Increased demand for traveling and vacations in Greece, gradual maturity of supply chain and synergies among Group entities, which employs 1,750 people during peak summer months, contributed for the historical highs, following an outstanding 2021.

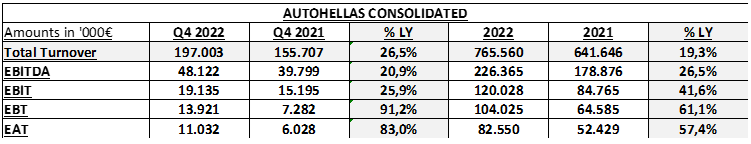

During 2022 revenue reached €765.6 million (+19.3%) compared to €641.6 million in 2021. Operating profit (ΕΒΙΤ) resulted in €120.0 million (+41.6%) compared to €84.8 million, whereas Group profit after tax (ΕΑΤ) for 2022 reached €82.5 million compared to €52.4 million, recording an increase of 57.4%.

In Q4 2022, Revenue increased 26.5% and reaching €197.0 million compared to €155.7mil the respective quarter of 2021. Operating profit of Q4 (ΕΒΙΤ) reached €19.1 million whereas profit after tax (ΕΑΤ) recorded an increase of 83.0% and reached €11.0 million. It is noted that during Q4 “HR Aluguer de Automóveis S.A.”, Hertz franchisee in Portugal, was consolidated for the first time adding 18.3 million revenue in Group results, but without material effect in profitability, since its only activity, namely short-term rentals, have intense seasonality with negative results in Q1 and Q4 of each year.

Segmental analysis:

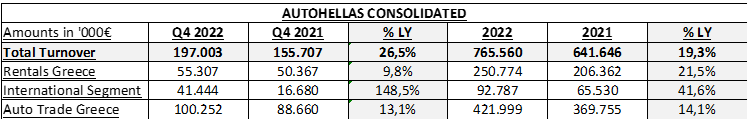

Greece rentals increased 21.5% in revenue in 2022, reaching €250.8 million compared to €206.4 million in 2021. This increase mainly stems from short-term rentals, where the exceptionally positive course of touristic demand towards Greece, the additional upgrade of network locations and the strong market shares of AUTOHELLAS were the drivers for improved figures. Especially during the past 2 years, there has been a significant investment for the expansion and quality upgrade of the company’s short-rental fleet with new vehicle types and gradually more plug-ins and electric vehicles. The segment’s profitability was significantly supported by the high rates of used car sales, which follow the price evolution of new cars. Overall, rentals in Greece employ 64% of Group assets and generate circa 62% of the Group’s operating profit.

Regarding Rentals Segment of International Subsidiaries, after the first consolidation of Portuguese company “HR Aluguer de Automóveis S.A.” only for Q4 2022, Revenue reached €92.8mil in total, up from €65.5 million in 2021 employing 18% of Group assets and contributing circa 13% of Group’s operating profit.

Auto trade segment also materially increased by 14.1%, mainly from Import/Distribution arm (Hyundai, KIA, SEAT) contributing a total €422.0 million in Group Revenue and circa 25% in Group’s operating profit, employing only 18% of Group’s assets and with zero external financing in all 4 subsidiaries. The cumulative Group market share in retail registrations, excluding corporate fleet sales, surpasses 20%, whereas in total registrations the market share is at 15%. Effective from early May 2023, Auto Trade segment is expected to add another brand, namely the import and distribution of Fiat/Alfa Romeo/Jeep (FCA Greece) which will be acquired by a Joint venture of the Group with Samelet Group (Israel), following the approval by the Hellenic Competition Commission (18/1/2023 Decision No. 806/2023)

In total, short-term and long-term rental fleet reached 53,700 cars, including 11,700 total purchases and Group net CAPEX (purchases less used car sales) of €146 million.

The Board of Directors will propose its shareholders, in the upcoming Annual General Meeting, the distribution of 0.65 euros/ share, compared to 0.46 in previous year.

It is noted that Autohellas, having included in its strategic planning an investment plan of €300 million for the next 5 years regarding car purchases of low and zero emmissions and create the necessary support and charging infrastructure, proceeded with signing two co-financing agreements with two commercial banks and the participation of Recovery and Resilience Facility, aiming to accelerate the inclusion of “green“ vehicles in its fleet. These agreements will facilitate in limiting to a degree, the effects from the significant interest increases, at least regarding the financing of electric vehicles which until today remain at higher purchase values than the conventional vehicles.