News & Releasess

Autohellas Group: Fiscal Year 2024 Results

5% Increase in Earnings After Tax

Positive Momentum in Rentals both in Greece and the Balkans

Proposed dividend: €0.85 per share

Autohellas Group announces its annual results for 2024, recording a historic high for the Group in terms of profits after tax for the 4th consecutive year.

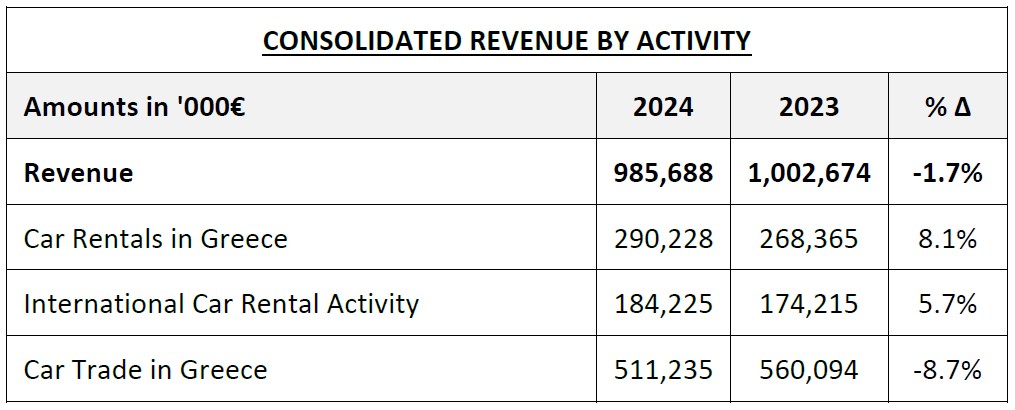

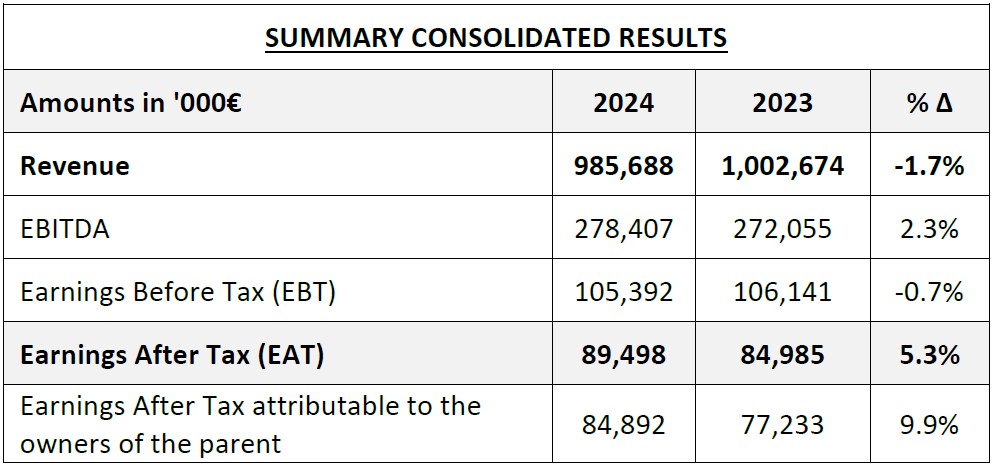

Consolidated revenue reached €985.7 million. compared to €1,002.7 million in 2023 showing a marginal decrease of 1,7%. Earnings before interest, taxes, depreciation and amortization (EBITDA) amounted to €278.4 million, reflecting a 2,3% increase, while earnings after tax stood at €89.5 million marking a 5% increase from 2023.

It is important to note that earnings after tax and minority rights attributable to Autohellas shareholders saw a larger increase of 9.9% compared to 2023, driven by the positive momentum in the rental business (where there are no minority shareholders).

Overall, the activity of short-term and long-term rentals in Greece, as well as in the 8 other countries where the Group operates, showed positive momentum both in terms of revenue and results, reaching a fleet size that exceeds 60,000 vehicles. The car trade activity was the one that experienced a slight decline from the high levels of 2023, leading to a marginal decrease in revenue. The profitability of 2024 (compared to 2023) was also supported by €8.0 million in dividends from AEGEAN and €1.6 million from the dividend distribution of Trade Estates.

The Group benefited significantly from the reduction in financing costs due to the movement of interest rates, the issuance of its first tradable bond loan, as well as the conclusion of new securitization agreement for long-term leases with significantly better terms.

At the same time, the Group’s equity as of 31/12/2024 amounted to €490 million.

Based on the results for the year, the Board of Directors will propose a dividend of €0.85 per share for the 2024 fiscal year at the upcoming General Assembly.

Αnalysis by Sector:

Greece Rentals

Revenue from the Car Rental activity in Greece in 2024 increased by 8.1%, reaching €290.2 mil. The growth momentum came from both Long-term and Short-term Rentals. The Long-term Rentals activity showed comparatively higher growth, improving the Group’s market share in Greece. The improvement in fleet utilization and further exploitation of all available sales channels positively contributed to the overall increase in operational profitability, despite the high availability of vehicles in the market, which led to a slight decrease in rental prices.

International Activity

Revenue from the international car rental activity reached €184.2 million, recording an increase of 5.7%. In most of the markets where the Group operates, tourist traffic was stronger. However, the increased availability of car fleets led to a slight decrease in prices compared to 2023, mainly affecting operational profitability in the Portuguese market, which is the only country where the activity does not include long-term rentals (operating leasing).

Car Trade and Services

The Car Trade activity in Greece decreased by 8.7%, contributing a total of €511.2 million to the Group’s revenue. In 2024, the activity faced pressure from the stagnation of the overall market compared to 2023, when the order portfolio accumulated in 2021-2022 was exhausted, as well as from the entry of new competitive manufacturers/brands into the Greek market. Despite the slight decrease in turnover, the Group managed to maintain the profitability of the sector at satisfactory levels.

It should be noted that the activity of Italian Motion (FIAT/JEEP/ALFA Romeo), which does not participate in the Consolidated Revenue (accounted for only under the equity method), achieved sales of €155.8 million in 2024, further increasing the Group’s overall activity and momentum.